Dear Clients and Partners,

As we stand on the threshold of a new year, we extend our warmest wishes to you. Reflecting on the past year, we believe it is essential to share both a review and our vision for 2025.

Our predictions of price increases for 2024 proved to be accurate. These forecasts were based on ten key factors that remain just as relevant today (see here for our 2024 insights).

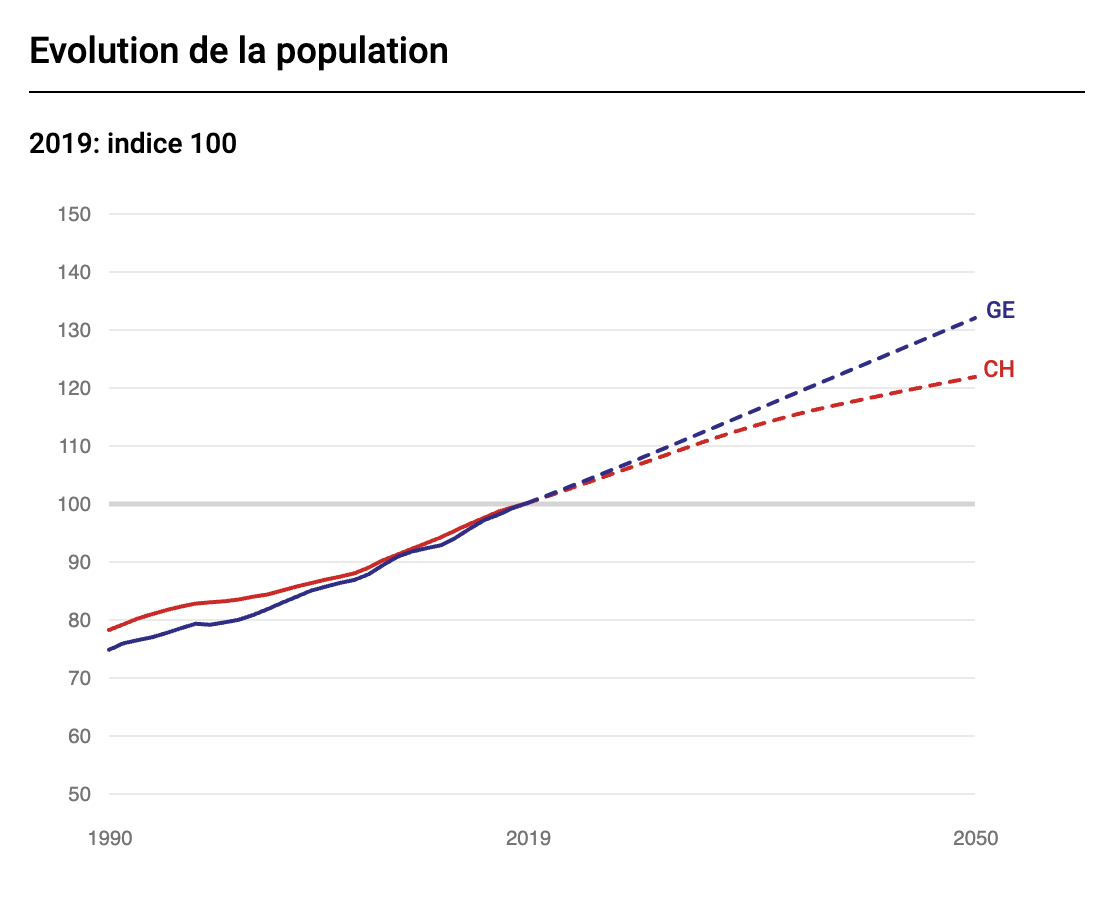

The demographics of Greater Geneva continue to grow. This cross-border metropolitan area now has over 900,000 residents, making it the second-largest agglomeration in Switzerland after Zurich (1,354,000 inhabitants) and ahead of Basel (852,000 inhabitants). Of these 902,500 residents, 65% live in the Swiss part and 35% in the French part.

According to the Cantonal Statistics Office (Ocstat), Geneva’s population is projected to grow significantly. Between 72,000 and 151,000 new residents are expected by 2050, representing a 14% to 30% increase. The canton’s population is predicted to reach 600,000 by 2044 under a mid-range scenario, or even by 2038 if immigration remains high.

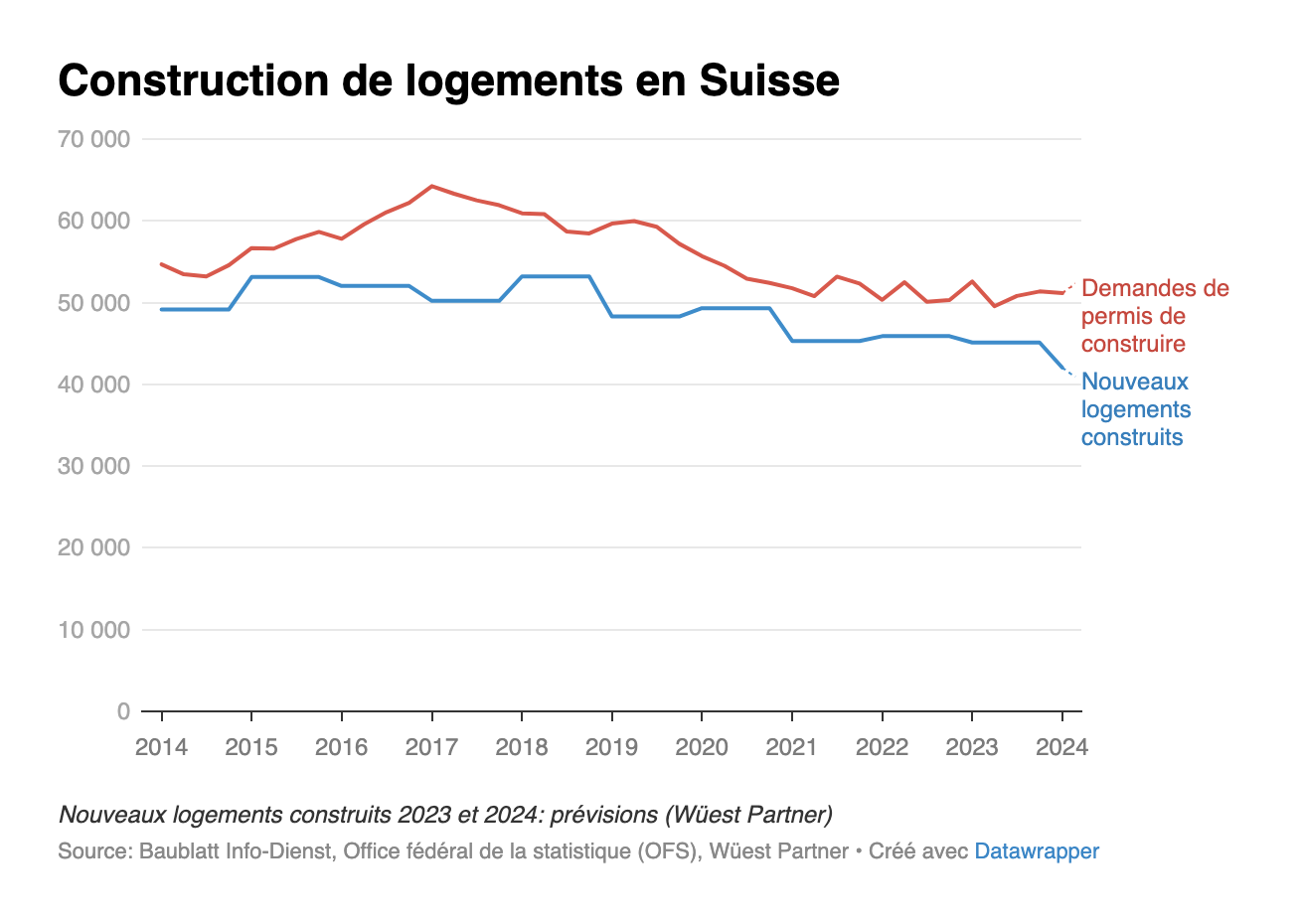

The main challenge lies in the insufficient number of building permits, often blocked by neighbor appeals or administrative hurdles. In 2023, the number of building permits delivered fell by 23%*, exacerbating an already strained situation. Additionally, construction opportunities in the city are becoming increasingly scarce, while agricultural areas and the lake remain naturally off-limits for real estate projects.

The only alternative for building condominium apartments (PPE) lies in villa zones. However, no political party dares to propose densifying these areas. On the cantonal side, no significant changes are expected: the left focuses solely on creating development zones, while the right, concerned about its electorate, refuses to promote densification near its supporters’ gardens.

The two-year moratorium on new constructions in villa zones has severely impacted housing supply. Although it has been lifted, its effects will be felt for decades due to the loss of several thousand potential housing units during that period. This moratorium, intended to give municipalities time to designate densifiable areas, has yielded no tangible results. On the contrary, municipalities have tightened restrictions in their master plans, effectively making the construction of new PPE almost impossible. As a result, the primary reservoir for new housing remains completely blocked.

This situation can only change with federal intervention from Bern, such as increasing authorized densities, limiting excessive neighbor appeals, and simplifying cantonal laws, arbitrary decisions, and administrative delays. Unfortunately, no such changes seem to be planned at this time.

Key factors influencing the evolution of the real estate market

Two Emerging Factors Likely to Influence the Swiss Romandy Real Estate Market in 2025:

- Falling interest rates

- Accelerated decline in France and Germany

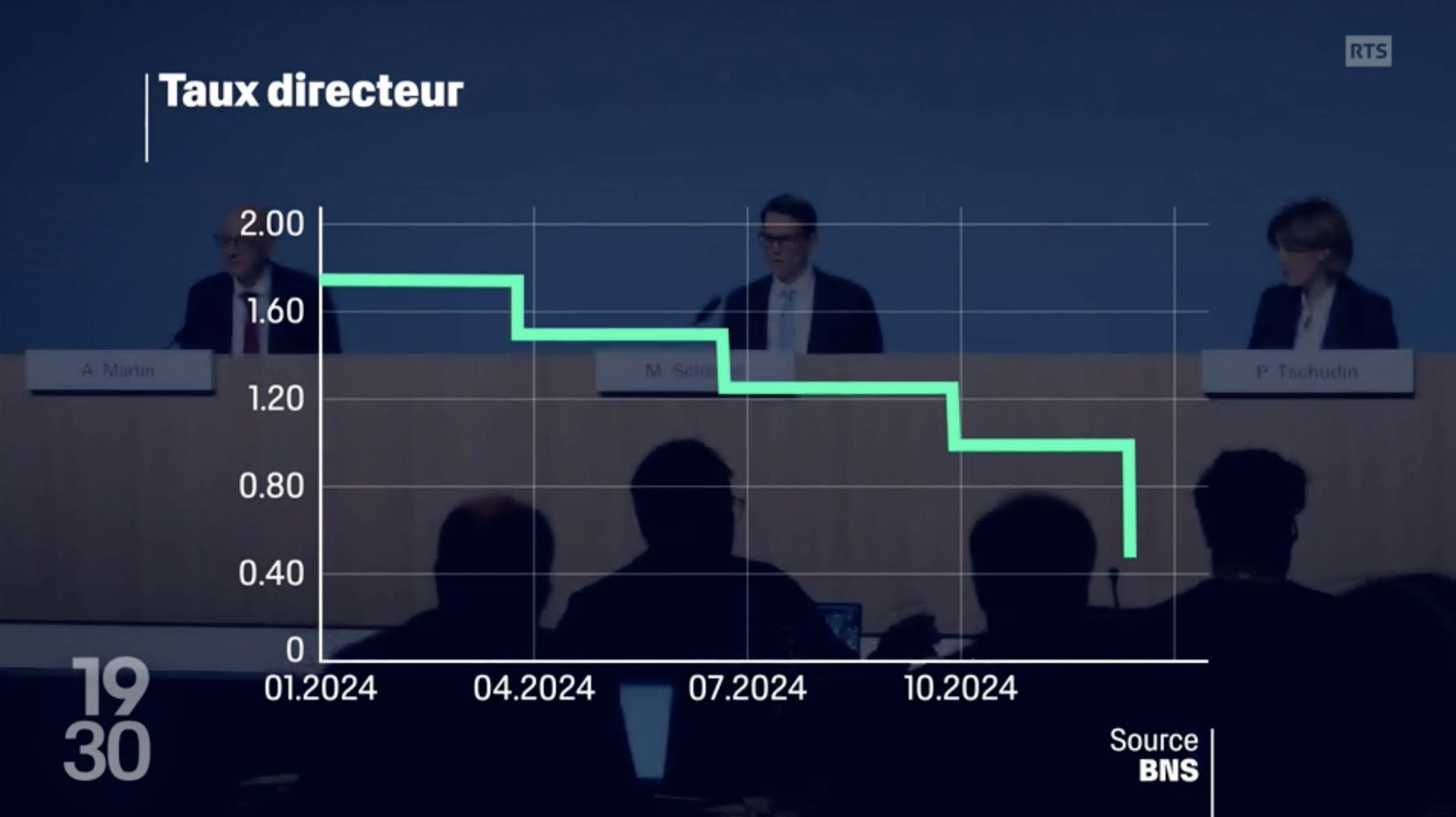

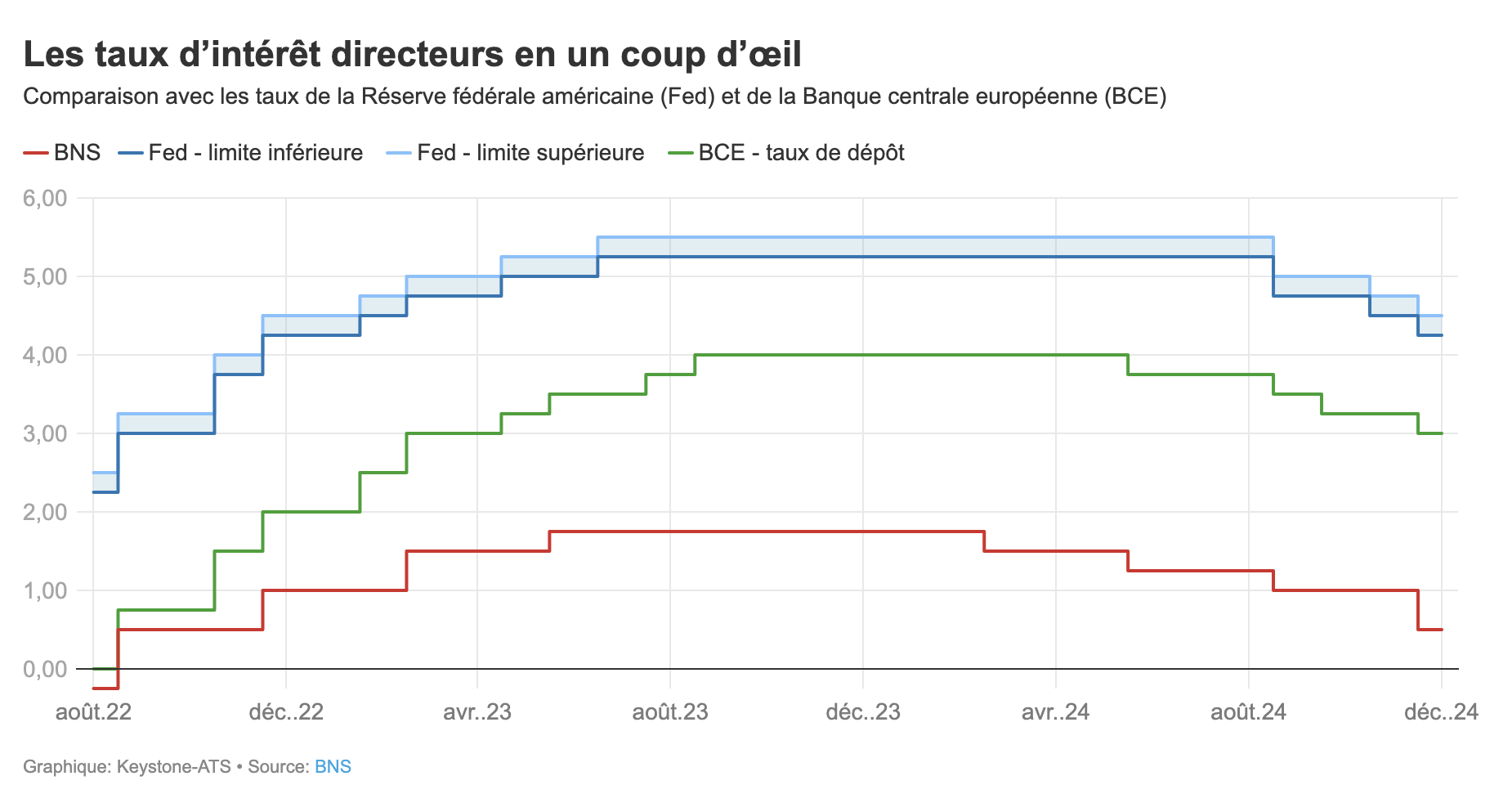

In 2024, the Swiss National Bank (SNB) reduced its key interest rate four times: first by 0.25 percentage points three times, then by 0.5 points in December, bringing the rate down from 1.75% to 0.5%.

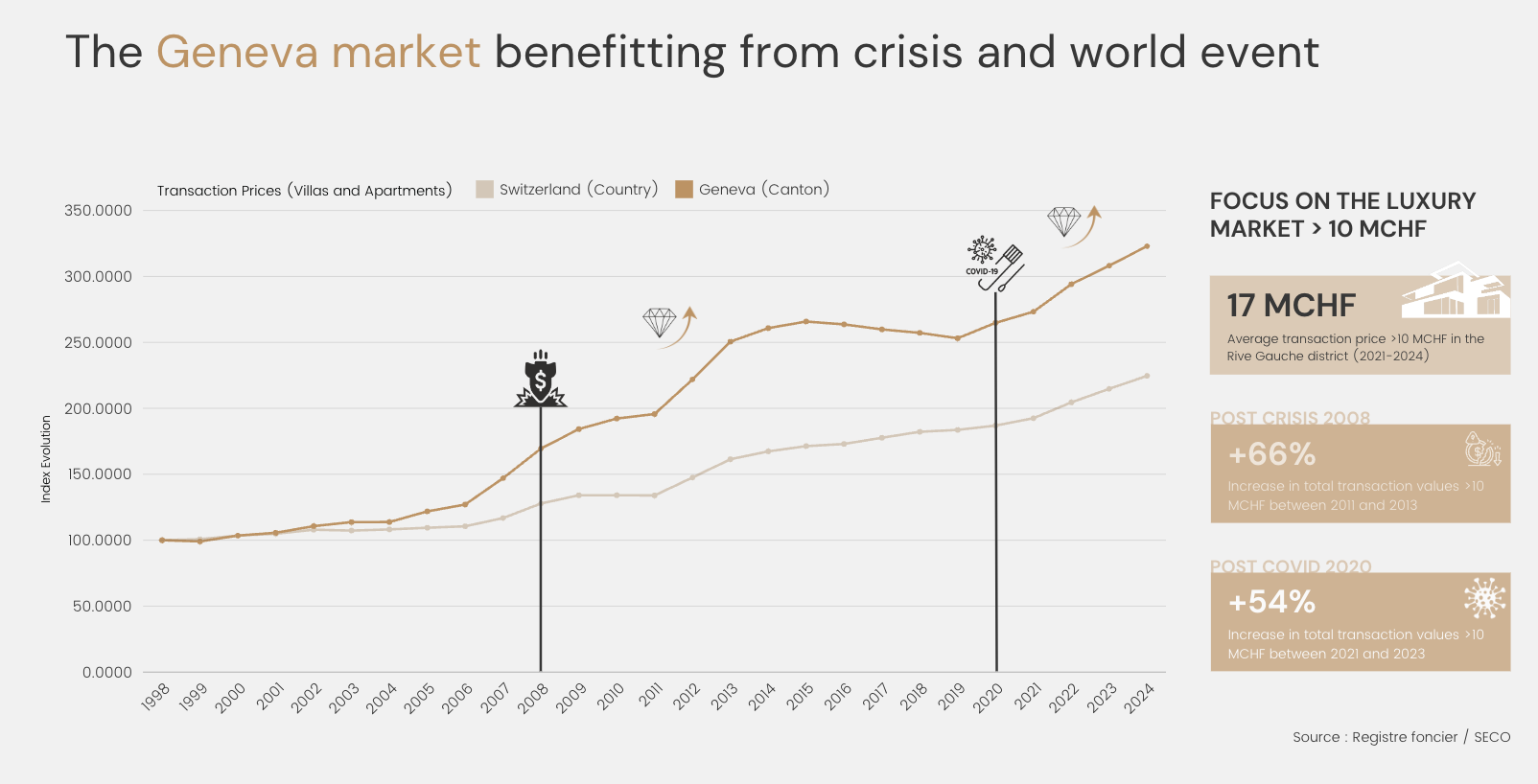

Experts agree that Europe is on the verge of a major crisis, which will have several favorable repercussions for Swiss real estate:

- Neighboring countries, in search of new revenue streams, will likely increase taxes, thereby encouraging wealthy foreign investors to turn to Switzerland.

- Economic stagnation and rising debt levels in these countries will push them to lower their interest rates, which Switzerland may also follow.

- Changes in the security and political climate in neighboring countries are driving an increasing number of foreigners to migrate to Switzerland.

- The Swiss franc (CHF) is expected to strengthen against the euro, and likely the US dollar, enhancing its appeal as a safe haven. The SNB may respond with further rate cuts.

- Additionally, the recent end of the “Non-Dom” regime in the UK, combined with a 40% inheritance tax and the abolition of trusts, could prompt up to 70,000 individuals to leave England. If just 0.5% of them choose Geneva (about 350 people), it could lead to a significant price surge in the luxury market.

These economic, fiscal, and social dynamics explain the 15% increase in residency permit applications in 2023 (source: Federal Migration Office), a trend expected to intensify in the coming years.

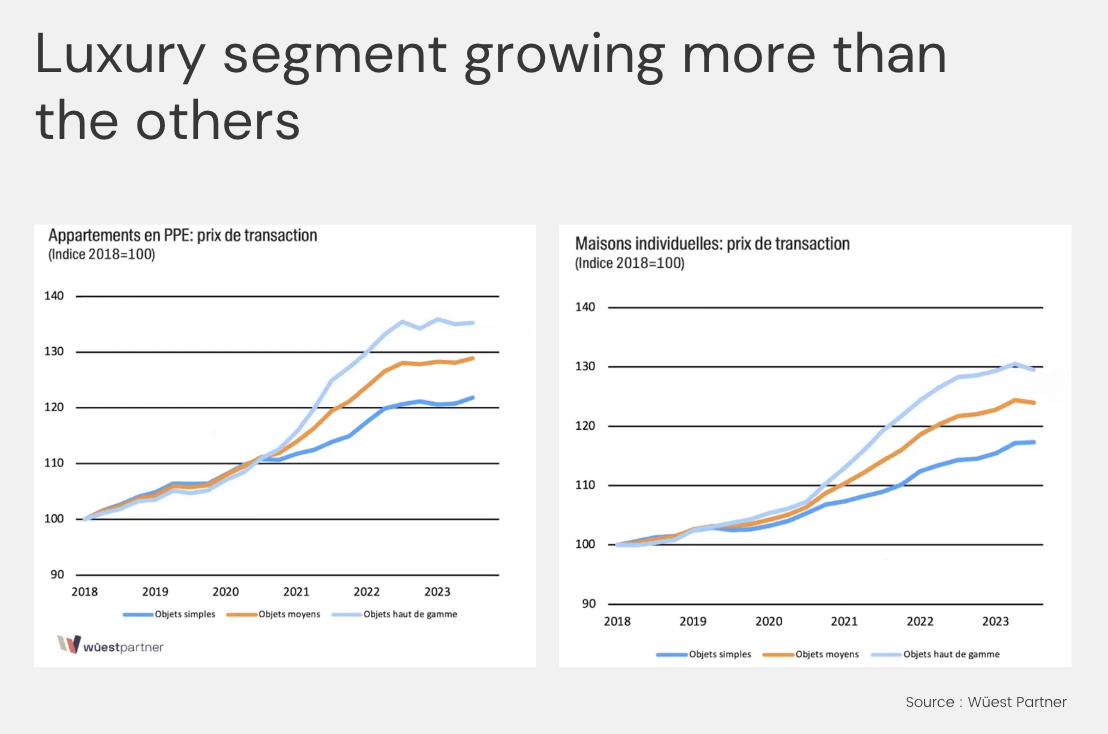

The real estate market situation remains the same as last year: limited supply, growing demand, but now with falling interest rates. A straightforward analysis predicts a further rise in prices. In 2024, we observed that luxury property prices increased by 10% to 20%, and this trend is likely to continue. The increase will be even more pronounced for prestige properties, where demand is more fluid, and turnkey properties are increasingly rare.

With a 3-year fixed rate close to 0.8%, purchasing a property is now significantly more advantageous than renting. This will likely encourage many tenants to take the leap.

All indicators suggest that high-end real estate prices will continue to rise in 2025. However, it is crucial not to repeat the mistakes of our neighbors. It has been proven that after every tax cut, state tax revenues increase. Within the left, some recognize that their social spending depends on the presence of multinationals and wealthy individuals. However, the more dogmatic youth wing of the Socialist Party remains active and regularly proposes referendums that could trigger fiscal exile, as seen in London. If one of their proposals were to pass, the consequences could be immediate and severe. The initiative to tax inheritances and donations exceeding CHF 50 million is one to watch closely.

Now is the time to buy, but choosing the right property and location is key. Our advisors are available to provide detailed analyses, neighborhood by neighborhood. We also offer the opportunity to invest or even co-invest with us.

We wish you all a prosperous 2025, filled with new opportunities.

Sincerely,

Léonard Cohen

President